IR InformationINVESTOR RELATIONS

Corporate Governance Guideline

1. Fundamental philosophy

Tomoku Co.,Ltd. recognizes that collaboration with all stakeholders, including shareholders, is indispensable for sustainable growth and the creation of corporate value over the medium and long term. In order to practice collaboration with all stakeholders, we have established the "TOMOKU Group Management Philosophy" and "TOMOKU Group Code of Conduct". We strive to foster the corporate culture that respects the rights and positions of all stakeholders under the leadership of the Board of Directors and Management Team. In addition, we are also engaged in environmental conservation activities in harmony with our business activities in order to pass on the livable earth to future generations in accordance with our management philosophy of "Providing value for consumers, enveloping life with sustainability and conservation for the our clients and the global environment". In accordance with this concept, we will continue to enhance "Corporate Governance" which is a mechanism for transparent, fair, prompt, and strong-minded management decision-making, and commit to further leverage "corporate value".

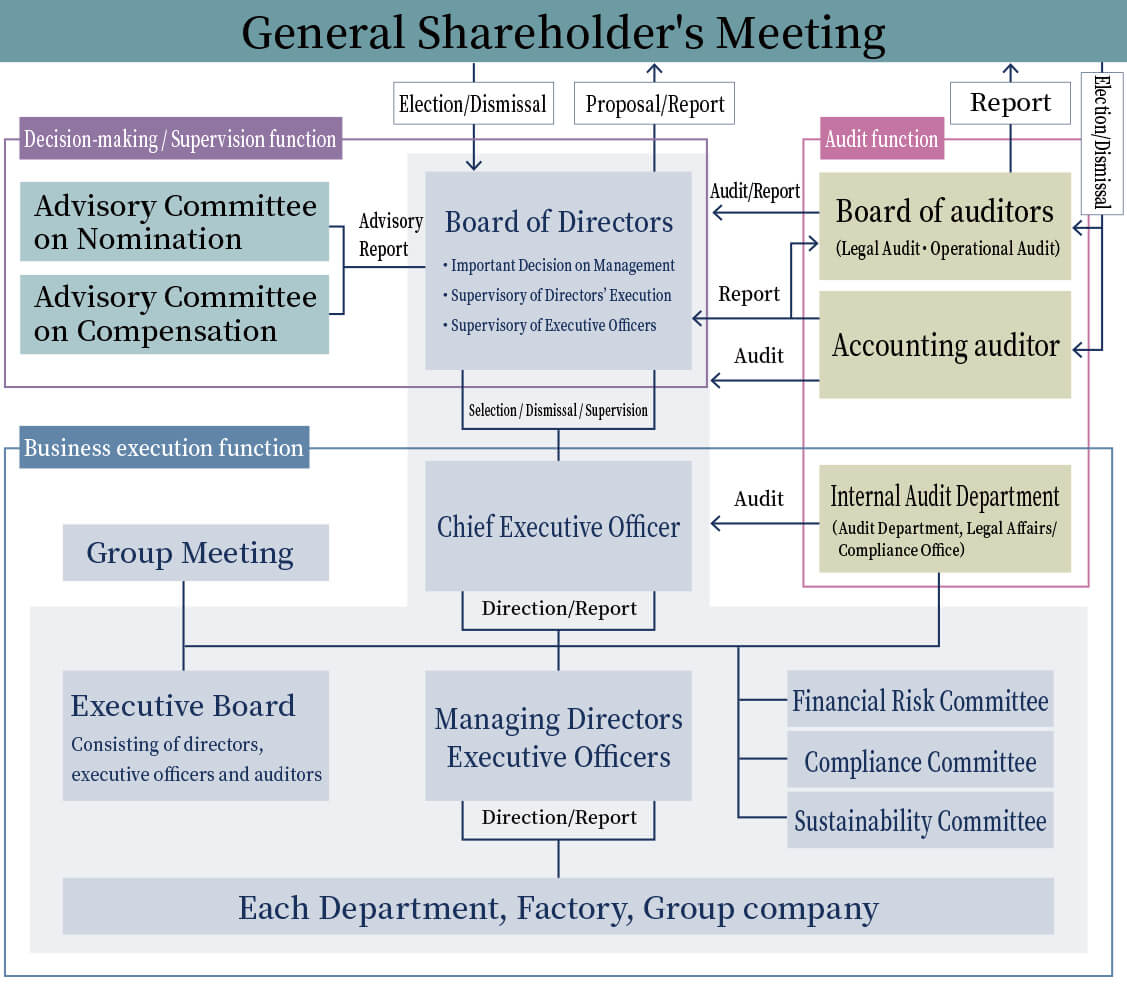

2. Corporate governance system

- We make important decisions on management and execution of operations in the Board of Directors’ meeting and supervise the execution of business operations by each director and the execution of duties by executive officers in accordance with the direction outlined in the group management philosophy and so on.

- We introduced the "Executive Officer System" in June 2000 in order to separate the execution of management and the execution of business.

- We have adopted the company auditing system in which the Audit & Supervisory Board conducts audits of business operations by each director and strives to build a corporate governance structure that will earn the trust of stakeholders.

- We have established Nomination and Compensation Advisory Committees chaired by independent Outside Directors in order to ensure validity and transparency of election of directors and executive compensation.

3. Board of Directors

- The Board of Directors makes decisions on matters stipulated in laws and the articles of incorporation as well as important matters relevant to Tomoku and group companies.

- The Board of Directors is responsible for formulating Group’s management strategies and medium-term management plans, making important decisions and supervising the execution of business operations. The Board of Directors includes Outside Directors with diverse viewpoints, advanced skills and a high degree of independence to ensure transparency and soundness of management.

- The Board of Directors provides the environment that supports optimal risk-taking actions and prompt and strong-minded execution of operations. The Board of Directors also confirms the effectiveness and feasibility of decisions made by executive departments and assesses risks, and evaluates medium- to long-term performance and potential risks, which are appropriately reflected in compensation and personnel decisions.

- The Board of Directors currently consists of 9 members including Outside Directors. Four of these members are Audit & Supervisory Board members including outside auditors.

4. Audit & Supervisory Board

- The Audit & Supervisory Board audits the decision-making process of the Board of Directors and execution of operations in accordance with laws and the article of incorporation.

- The Audit & Supervisory Board members and Outside Directors participate in internal critical meetings to provide advice and opinions from viewpoints independent from the executive departments and exchange opinions with the executive departments, internal audit department, auditing officers of affiliate companies and accounting auditors.

5. Advisory Committee of the Board of Directors

- We have established the Advisory Committee on Nomination and the Advisory Committee on Compensation.

- The Advisory Committee on Nomination reports to the Board of Directors on the validity of candidates from an objective point of view with respect to the nomination for Directors and Executive Officers.

- The Advisory Committee on Compensation reports to the Board of Directors on the validity of determined policy and levels of executive compensation from an objective point of view.

6. Outside Directors

- In order to secure substantial independence of Outside Directors, we appoint them based on the standards formulated to determine the independence of candidates, taking into consideration their attributes such as high independence, abundant experience, high level of expertise, and depth of insights.

- We receive advice and opinions on a wide range of matters, not limited to the agenda of the Board of Directors meetings, but also on management policies and overall management, in order to achieve sustainable growth of the company and enhance corporate value from a diverse range of viewpoints of Outside Directors and shareholders.

7. Executive Compensation

- Executive compensation consists of basic compensation and executive bonuses linked to performance. The retirement bonus system for Executive Directors has been abolished.

- The basic policy is that the remuneration of directors shall consist of fixed remuneration that functions as an incentive for sustainable growth and executive bonuses for productivity-linked variable remuneration according to the performance of a single fiscal year. It will be paid at an appropriate level as compensation for the execution of duties by each director.

- Individual remuneration (fixed remuneration) for directors is calculated based on the guideline that sets standards according to the position and role of directors and is resolved by the Board of Directors through a decision procedure based on the report of the Advisory Committee on Compensation.

- Individual remuneration (productivity-linked variable remuneration, executive bonus) is calculated for each individual based on ordinary income following the "calculation criteria for director bonuses" and is resolved by the Board of Directors through a decision procedure based on the report of the Advisory Committee on Compensation.

8. Policy on Constructive Dialogue with Shareholders

- We strive to ensure the substantial equality of shareholders and create an environment in which the rights of shareholders are secured and appropriately exercised, including the shareholders’ ability to smoothly exercise their voting rights. Furthermore, in a timely and appropriate manner, we disclose information concerning our own and our affiliate companies’ business, management and performance which have a significant impact on investment decisions.

- In order to promote dialogue with shareholders, we have established IR Department supervised by a director. IR Department works with related departments to provide accurate and unbiased information to shareholders for constructive dialogue at the General Shareholders’ Meeting and financial results briefings.

- We respond to individual interview requests from shareholders such as institutional investors and engage in dialogue on management strategies, business situations and shareholder returns from a long-term perspective with the aim of enhancing corporate value.

- We have established “Regulations on Internal Information Control” and fairly disclose information for dialogue with shareholders. We do not selectively disclose information to any specific person and thoroughly manage insider information control by consolidating information.