CSR/SustainabilityCSR ・ Sustainability

Disclosure Based on the TCFD Recommendations

The Tomoku Group endorsed the TCFD in May 2022, disclosing information based on TCFD recommendations since.

We understand that climate change is one of the most urgent global environmental issues, and that climate change will have a major impact on the global economy and society.

The Tomoku Group regards climate change as a top management priority, and pursue the reduction of greenhouse gas emissions and the efficient use of energy.

We will continue to actively disclose group strategies and responses, striving to enhance the quality and quantity of related disclosures.

1. Governance

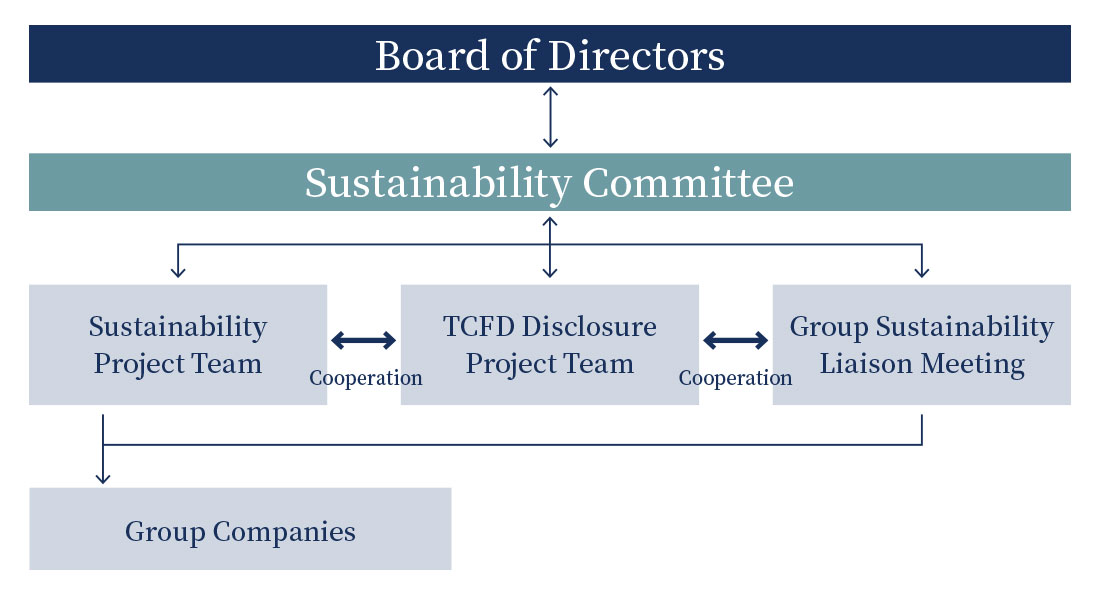

The President and CEO is responsible for the overall sustainability strategy, including climate change response in our group.

The Sustainability Committee, chaired by the President and CEO, including the Directors of Safety Promotion & Quality Assurance, Sales, and Administration as members, meets in principle four times a year to formulate policies, deliberate on initiatives, set targets, and manage progress related to sustainability, and reports to the Board of Directors.

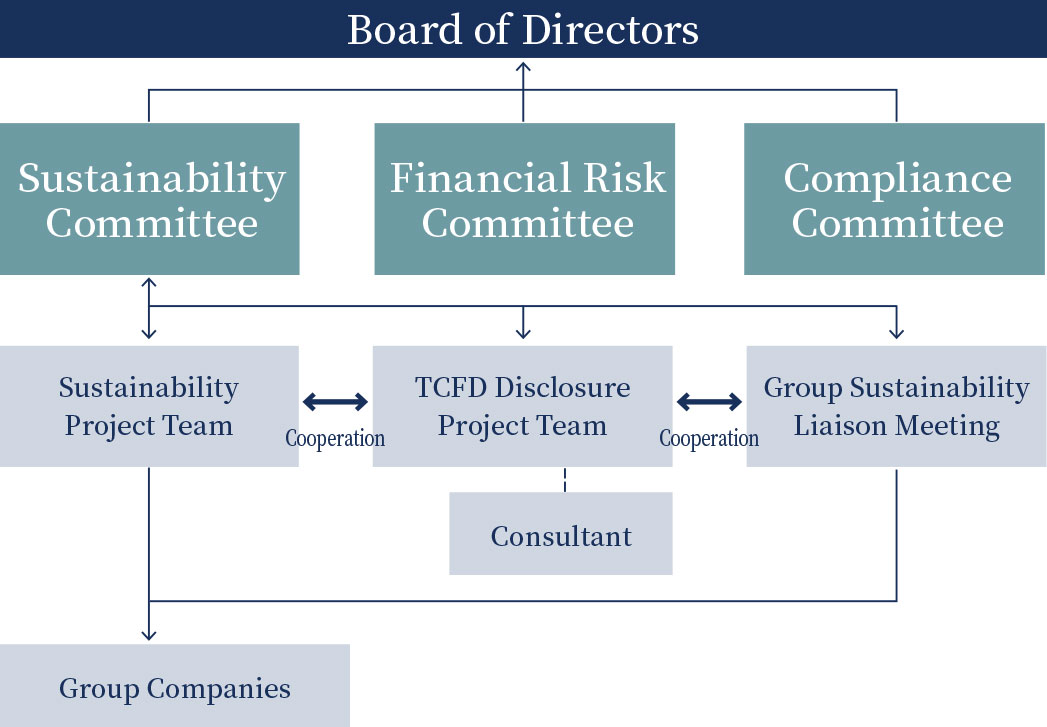

The Board of Directors receives reports from the Sustainability Committee, monitors the response to issues and the achievement of set targets, and supervises these efforts. (Figure 1)

Figure 1 Governance

Under the Sustainability Committee, the Sustainability Strategy Project Team (hereafter "Sustainability PT") led by the Director of Administration, the TCFD Disclosure Project Team (hereafter "TCFD Disclosure PT") led by the President and CEO, and the Group Sustainability Liaison Meeting led by the Deputy Director of Administration have been established as subordinate organizations.

The Sustainability Strategy Project Team, with the President's Office and the ESG Promotion Office serving as its secretariat, is composed of the heads of the Production, Sales, Administration, and Quality Assurance Departments, and discusses various responses and measures related to sustainability in general.

The TCFD Disclosure PT, with the ESG Promotion Office, the President's Office, and the Quality Assurance Department serving as its secretariat, is composed of the heads of the Corrugated Container and Display Carton, the Housing, and the Transportation and Logistics businesses, and discusses risks and opportunities related to climate change, as well as various measures from the perspectives of different businesses.

The Group Sustainability Liaison Meeting, with the President's Office and the ESG Promotion Office serving as its secretariat, is composed of executives from the group core companies in the Housing, and the Transportation and Logistics businesses. It collaborates with each PT to discuss and align on sustainability issues and measures to climate change mitigation measures across the group. Additionally, it plays a role in providing instructions and advice to group companies.

The Group Sustainability Liaison Meeting and each PT work in close cooperation with each other to make proposals to the Sustainability Committee, which then deliberates on those proposals.

2. Strategy

- 2-1 Materiality

-

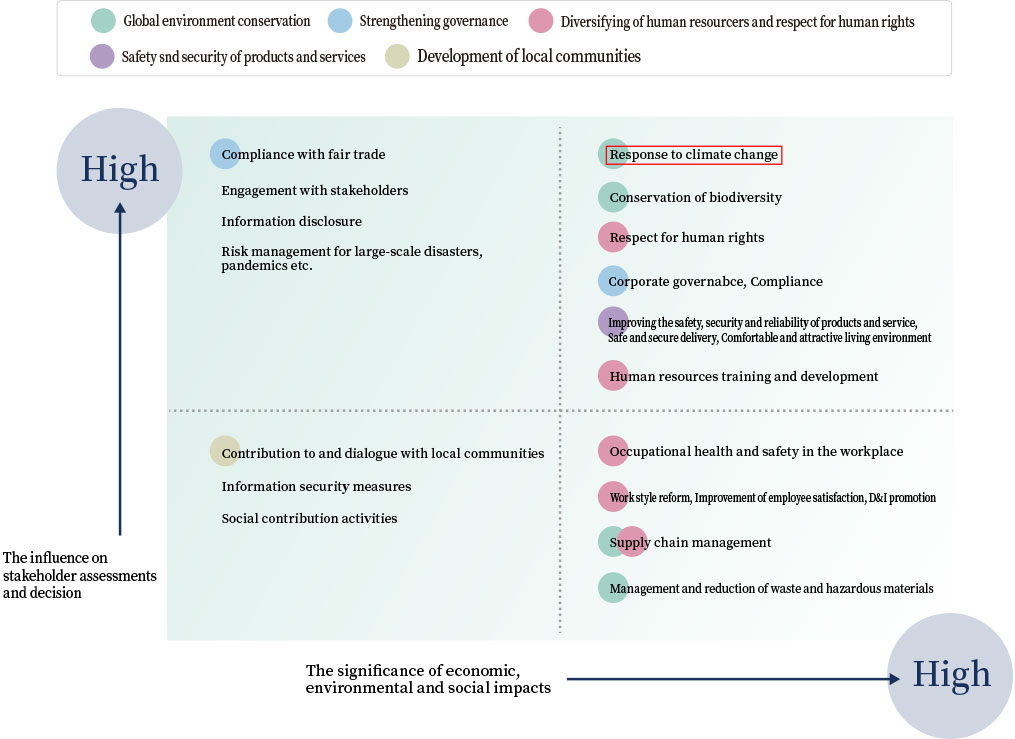

The Tomoku Group has selected twelve materiality issues to prioritize and address from the perspective of their impact on all stakeholders and our group. (Figure 2) Among these, addressing climate change has been identified as one of the highest priority issues, and we are actively working on it.

- 2-2 Scope of the Analysis

-

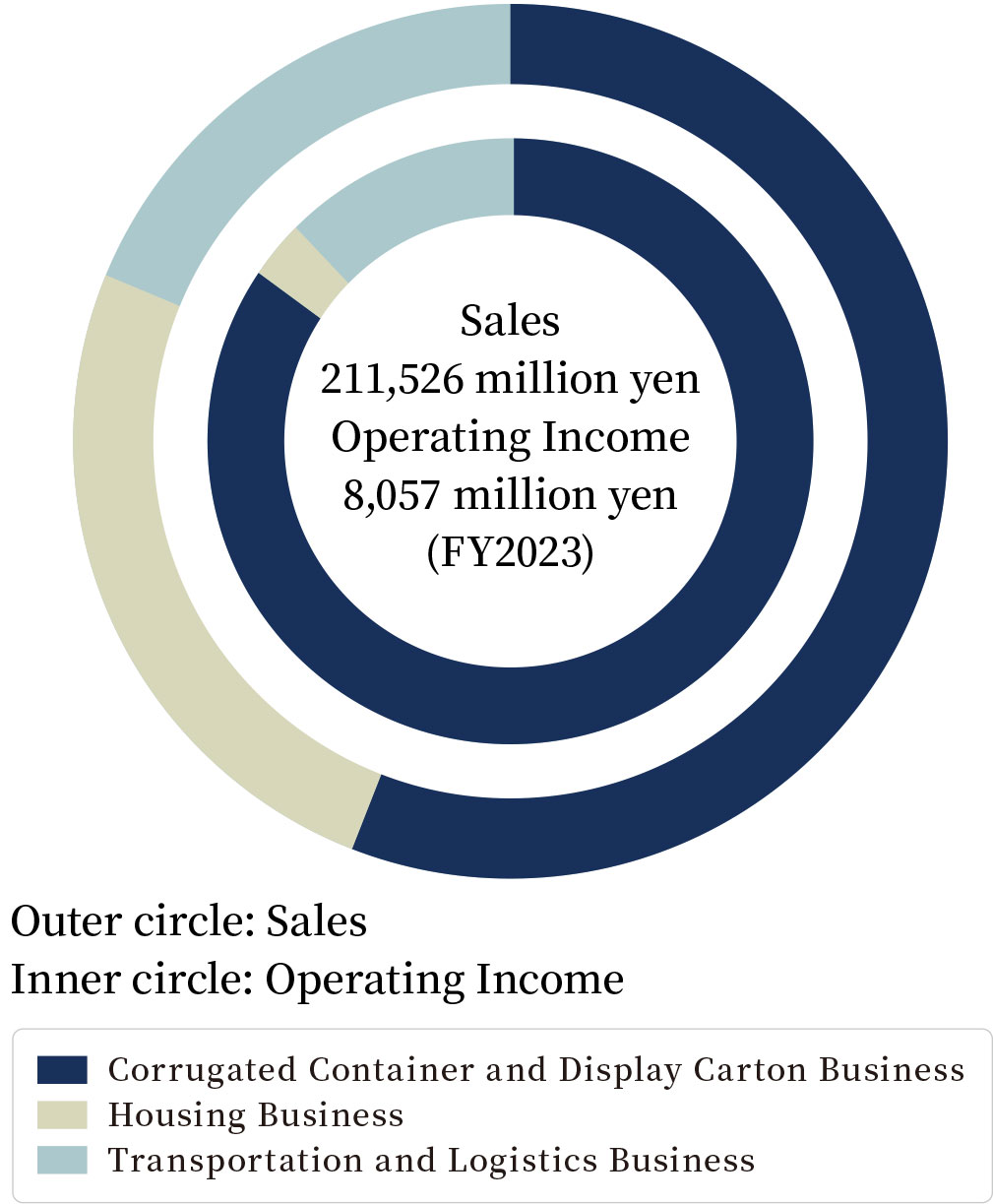

The scope of the scenario analysis has been expanded to include overseas consolidated subsidiaries in addition to the domestic core businesses, namely, the Corrugated Container and Display Carton, the Housing, and the Transportation and Logistics business. The sales and operating income by business segement for FY2024 are shown in Figure 3.

Figure 2 Materiality Issues

| Business in Scope |

|

|---|

Figure 3 Sales and Operating Income by Business Segment

- 2-3 Climate-related Scenarios

-

In the scenario analysis, we referenced the materials published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) to set the two future scenarios shown in Table 1 (the 1.5°C Scenario* and the 4°C Scenario).

Going forward, we will continue to use the latest data to enhance the accuracy of our scenario analysis. The results of these evaluations will be reflected in our business strategy to increase resilience in the face of an uncertain future.*If projected data is not available for the 1.5°C Scenario, the 2°C Scenario will be used.

Table1 Scenario Setting

Worldview A world where temperature rise is controlled by policies A world where rising temperatures and climate change are progressing 1.5°C Scenario 4°C Scenario Outline A scenario where the temperature rise in 2100 is limited to 1.5°C above the late 19th century average.

Due to strengthened regulations, transition risks such as carbon taxes have an impact.

On the other hand, the impact of physical risks is relatively small compared to the 4°C scenario.A scenario where the temperature in 2100 has risen by 4°C since the late 19th century.

Physical risks, such as the intensification of extreme weather events, have a significant impact.

On the other hand, since there is no regulatory tightening related to climate change, the impact of transition risks remains low.Scenario Transition IEA Net Zero Emission by 2050 (NZE)

IEA Sustainable Developement Scenario (SDS)IEA Stated Policies Scenario (STEPS) Physical IPCC RCP 2.6 IPCC RCP 8.5 - Scenarios in the IEA World Energy Outlook (WEO) are primarily used to assess transition risks and opportunities

- The IEA WEO 2019 was referenced for the SDS, while the WEO 2024 was used for other IEA scenarios

- The scenarios presented in the IPCC AR5 (Fifth Assessment Report) are utilized for the assessment of physical risks

- 2-4 Risks, Opportunities, and Strategies

-

We identified the expected risks and opportunities, and qualitatively evaluated the magnitude of their impact, categorizing them as high, medium, or low.

We assessed transition risks and opportunities based on the 1.5°C scenario, which is expected to have a significant impact, and physical risks and opportunities based on the 4°C scenario.

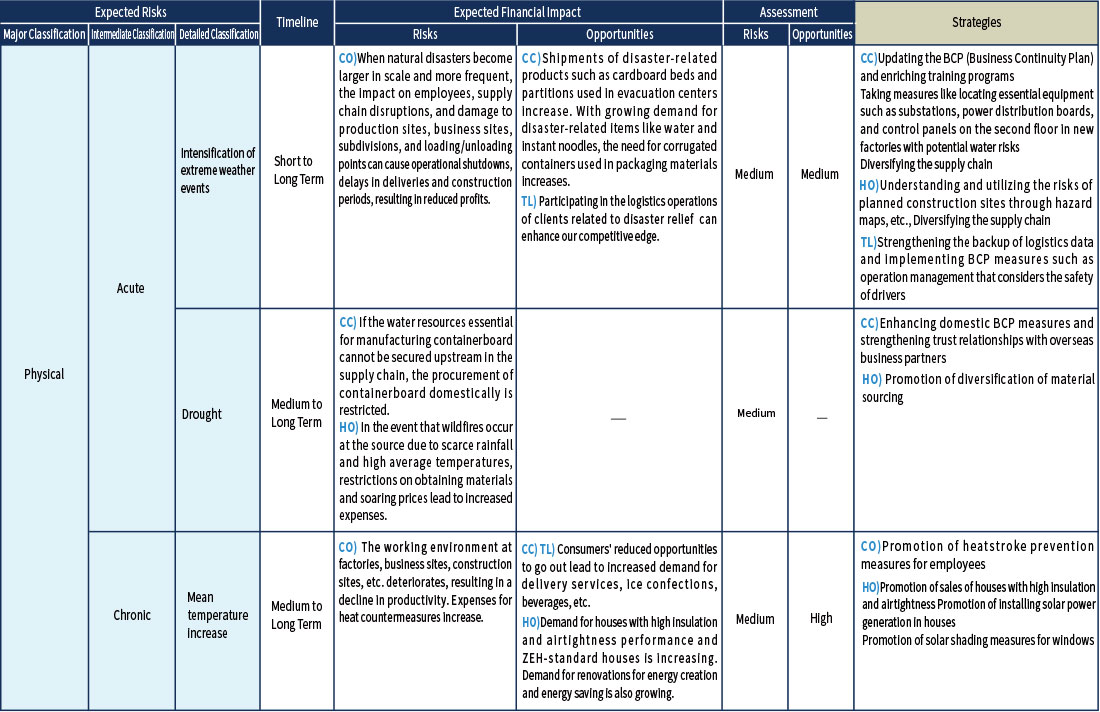

Our strategies for addressing these risks and opportunities, including the expected timing of their emergence, are summarized in Tables 2 and 3.

Table 2 Transition Risks, Opportunities, and Strategies (Mainly 1.5°C Scenario)

Table 3 Physical Risks, Opportunities, and Strategies (Mainly 4°C Scenario)

-

- Standards for Importance Assessment

- Using qualitative assessment,

High: The business may cease operations or undergo significant downsizing or expansion.

Medium: Some parts of the business are affected.

Low: The impact is negligible with almost no effect on the business.

-

- Timeline

- Short term: Up to approximately three years from now

Medium term: Until fiscal year 2030 (the target year for greenhouse gas emission reduction)

Long term: Until fiscal year 2050

-

- Business Classification

- CO)Common to Three Business CC)Corrugated Container and Display Carton Business

TL)Transportation and Logistics Business HO)Housing Business

2-5 Financial Impact Assessment

We assessed the impact of climate change-related business risks on our group’s operating income for FY 2024.

The risks evaluated were calculable carbon taxes, fossil fuel prices, and electricity prices for transition risks, and flood damage, storm surge damage, and business interruption for physical risks.

Other factors such as fluctuations in raw material prices, increases in sales opportunities, and environmental investments are also anticipated, but are excluded from the assessment due to the difficulty of estimation.

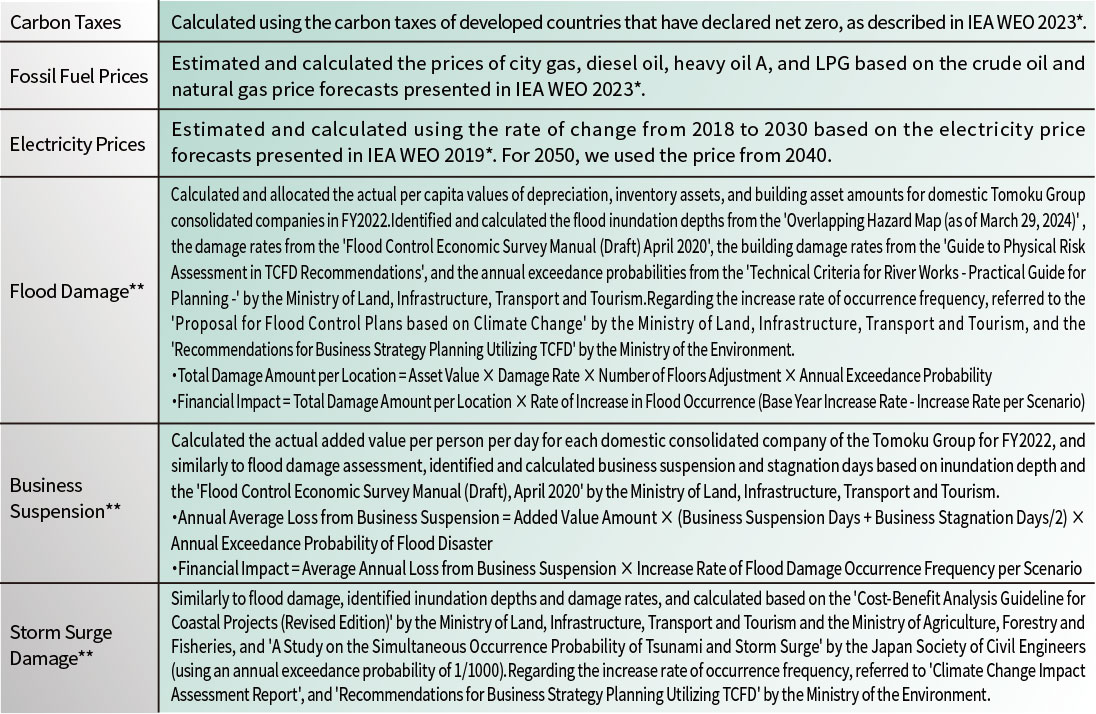

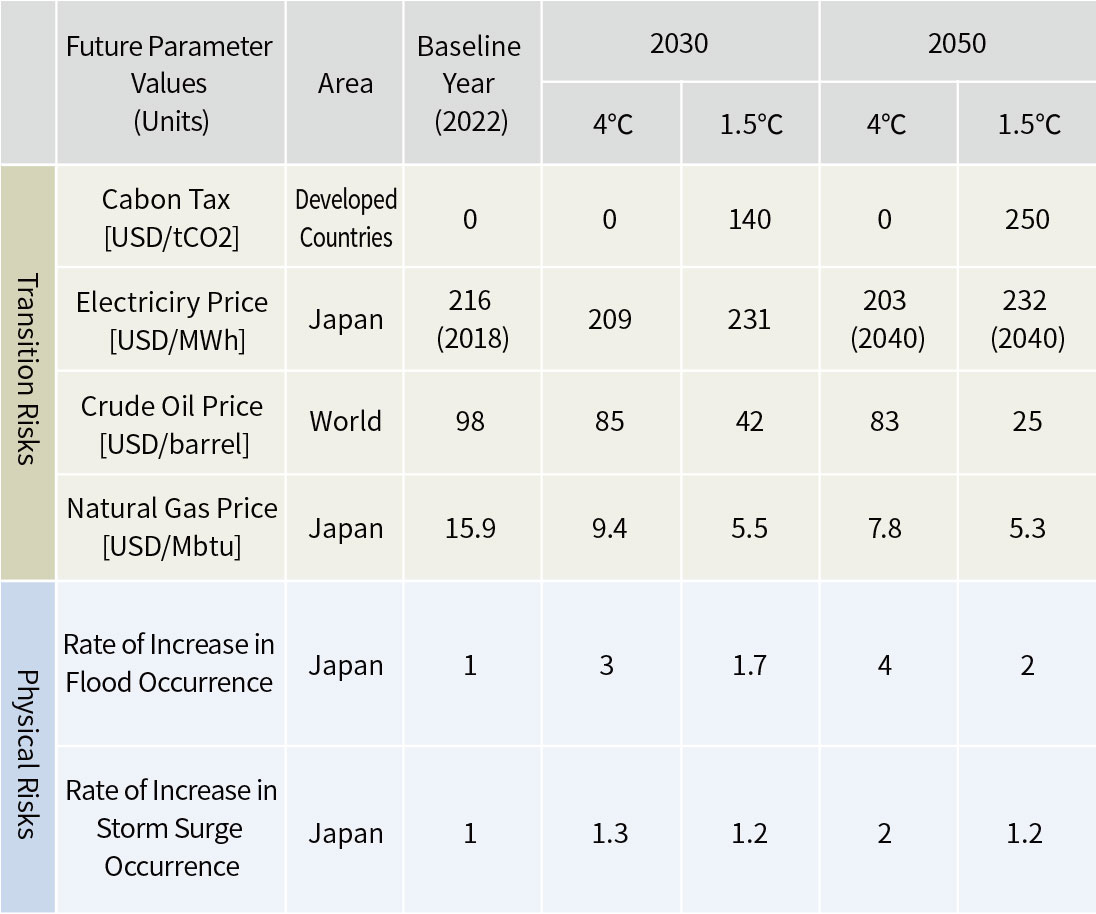

The reference materials and estimation methods used for the evaluation are shown in Table 4, and the parameters used in the estimation are provided in Table 5.

Table 4 Reference Materials and Estimation Methods for Transition Risks and Physical Risks

*The International Energy Agency World Energy Outlook. The exchange rate used was 149.52 JPY/USD, based on our group’s FY2024 financial results.

**Calculated the annual average amount of damage

Table 5 Parameters Used for Estimating Transition Risks and Physical Risks.

Financial Impact Analysis for Each Scenario

We applied the 2030 and 2050 scenarios to the FY2024 results (operating income, fossil fuel and electricity consumption) to estimate the financial impact as a risk.

Reduction Targets for Greenhouse Gas Emissions Assumed in the Analysis

- 【Corrugated Container and Display Carton Business】

-

We are currently working to switch all electricity used to renewable energy sources by 2030 and to reduce greenhouse gas emissions by 50% compared to FY2013 through environmental measures for boilers and on-site work lifts.

- 【Transportation and Logistics Business】

-

We are currently working to switch all electricity used to renewable energy sources by 2030.

- 【Housing Business】

-

Since the greenhouse gas emissions are significantly lower than those of other businesses, we have adopted the results from FY2024.

Note: The opportunities and strategies shown in Tables 2 and 3 have not been considered in the forecast because they are difficult to estimate.

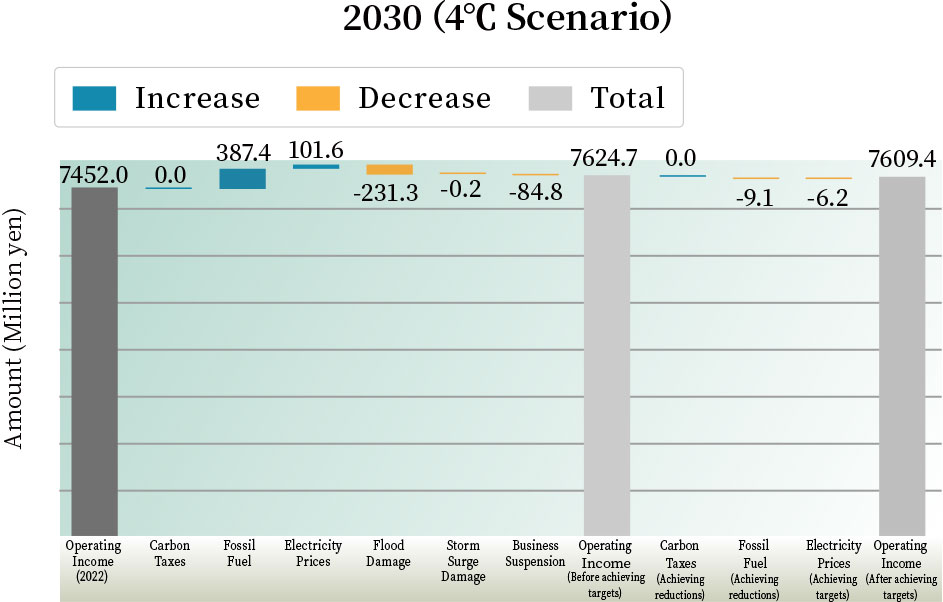

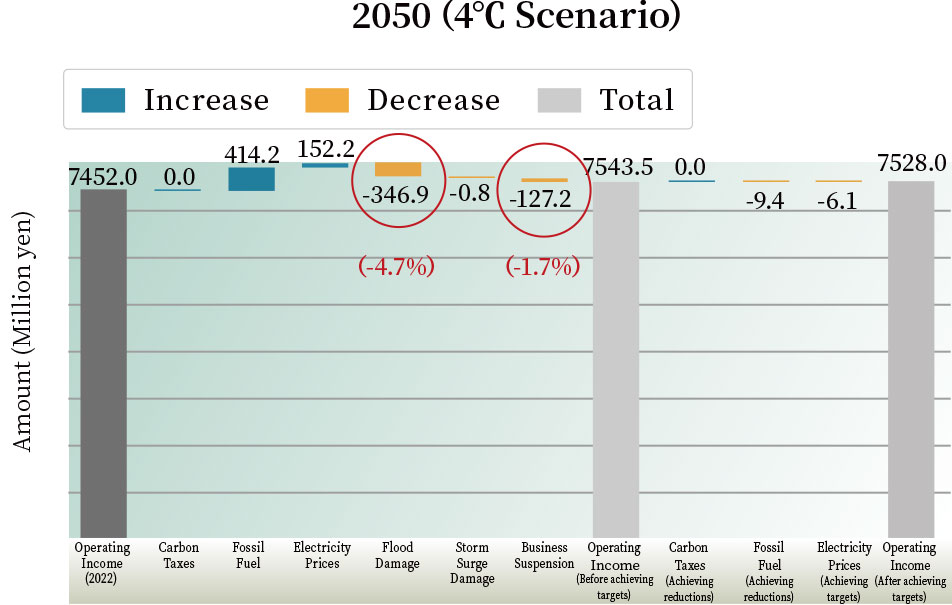

Assuming that the greenhouse gas emissions in 2050 will be equivalent to those achieved by meeting the 2030 targets, we added the financial impact before the target is met to the financial impact after the target is met. Figure 4 shows the total for the three businesses under the 1.5°C scenario, and Figure 5 shows the 4°C scenario.

Figure 4 Financial Impact Assessment of the Total Three Businesses (1.5°C Scenario)

Under the 1.5°C scenario, government policies such as carbon taxes are expected to become more significant. The estimated financial impact is approximately 1.45 billion yen in 2030 and 2.60 billion yen in 2050. The impact is expected to be particularly large in the Corrugated Container and Display Carton Business, as well as in the Transportation and Logistics Business, which rely heavily on fossil fuels.

Figure 5 Financial Impact Assessment of the Total Three Businesses (4°C Scenario)

Under the 4°C scenario, the impact of flood damage, storm surge damage, and the resulting business suspension is expected to be significant. The total estimated financial impact is approximately 570 million yen in 2030 and 860 million yen in 2050. Compared to last year’s report, which used FY2022 data and estimated the impact at approximately 320 million yen and 470 million yen respectively, the damage has increased due to worsening flood depths in hazard maps and an increase in asset value.

The sites covered in this assessment include nearly all of our group’s operations: 38 domestic and 2 overseas sites in the Corrugated Container and Display Carton Business, 78 domestic sites in the Transportation and Logistics Business, and 104 domestic and 1 overseas site in the Housing Business. Among these, the number of production and logistics center sites expected to experience flood depths of 3 meters or more—equivalent to below the second floor of a typical house—are 5 sites in the domestic Corrugated Container and Display Carton Business, 12 sites in the domestic Transportation and Logistics Business, and 1 site in the domestic Housing Business. These 18 sites have been designated as high-risk locations, and we will strengthen risk management measures for them going forward.

2-6 Strategy Summary

- Transition Risks and Opportunities

(Risks)

In both 2030 and 2050, under the 1.5℃ scenario, the introduction of carbon tax policies poses a risk of increased costs in the Corrugated Container and Display Carton Business, which uses fossil fuels as boiler fuel, and in the Transportation and Logistics Business, which uses fossil fuels as truck fuel.

As a countermeasure, reducing greenhouse gas (GHG) emissions generated from business activities is essential. In the short term, we aim to mitigate risks by implementing feasible measures such as electrifying on-site work lifts, improving truck fuel efficiency and vehicle utilization rate, and maintaining the switch to electricity derived from renewable energy sources. In the medium to long term, we plan to invest in initiatives such as switching boiler fuel from heavy oil to city gas, which emits less GHG during combustion, utilizing biofuels, and adopting decarbonization technologies and infrastructure including next-generation boilers and trucks powered by green hydrogen. Additionally, for GHG emissions that are difficult to reduce, we will consider the possibility of carbon offsetting through the use of credits.

(Opportunities)

In the Corrugated Container and Display Carton Business, the tightening of plastic regulations is expected to create opportunities for increased demand for recyclable and environmentally friendly corrugated containers and paper products as alternative materials.In the Housing Business, there are expected opportunities for market expansion in houses featuring high insulation and airtightness, which contribute to lower energy consumption. In each business, we will seize business opportunities by promoting design and technological innovation.

- Physical Risks and Opportunities

(Risks)

Under the 4°C scenario projected for 2050, the intensification of extreme weather events is expected to increase the frequency of natural disasters. This poses risks across all business operations, including damage to production facilities and construction sites, disruptions of supply chains and lifelines, and employees being affected by disasters, leading to temporary suspension of production and sales, as well as delays in delivery dates and construction periods.

Additionally, the chronic rise in average temperatures raises concerns about the risk of deteriorating working environments and decreased productivity.

We aim to reduce risks by establishing and strengthening business continuity frameworks, such as reinforcing production and logistics backup systems, diversifying our supply chain, ensuring employee safety, improving working environments, and implementing an employee safety verification system.

(Opportunities)

In the Corrugated Container and Display Carton Business, as well as in the Transportation and Logistics Business, increased demand for delivery services, beverages, and disaster-related products is expected.

In the Housing Business, even if temperatures continue to rise, the market for houses featuring high insulation and airtightness with low energy consumption is expected to grow, and we aim to secure business opportunities across all businesses.

3. Risk Management

Figure 6 Risk Management

-

Regarding risks related to climate change, the TCFD Disclosure PT, based on consultant advice, is selecting risks across the entire group, evaluating the financial impact amounts they may have, and considering necessary countermeasures.

Regarding critical climate change-related risks that are high priority or have a significant impact on our group, the TCFD Disclosure PT collaborates with the Sustainability PT to report to the Sustainability Committee. The Sustainability Committee deliberates on the response and reports to the Board of Directors.

-

In our group, the President and CEO serves as the person responsible for overall risk management. Important decisions and revisions regarding risk management policies are deliberated and decided by the Board of Directors.

Risks related to sustainability in general, including climate change, that have been assessed by the Sustainability PT and the TCFD Disclosure PT are requested to be addressed by each group company through the Sustainability PT and the Group Sustainability Liaison Meeting. Each company formulates and implements various countermeasures.

The Sustainability Committee receives reports from the Sustainability PT and verifies and manages the progress status. (Figure 6)

4. Metrics and Targets

Recognizing climate change as a significant management issue, our group sets greenhouse gas emissions (Scope 1 and 2) as a metric and has established targets for their reduction.

In response to Japan’s new Nationally Determined Contribution (NDC) submitted to the United Nations in February 2025, our group will proceed with formulating long-term targets. In the short term, we will continue implementing measures such as introducing electricity derived from renewable energy sources, fuel conversion, improvements in fuel efficiency, and the installation of energy-efficient equipment. The provisional roadmap is presented in Table 6.

| GHG Emissions Reduction Targets | A 50% reduction in greenhouse gas emissions (Scope 1 and 2) by FY2030 relative to FY2013 levels |

|---|---|

| Ratio of Electricity Derived from Renewable Energy Sources | 100% by FY2030 |

Figure 6 Roadmap to FY2030 (Three Domestic Businesses)

Regarding overseas operations, we will consider introducing electricity derived from renewable energy in Vietnam, excluding Sweden where renewable energy is already widely adopted.

【FY2024 Results】

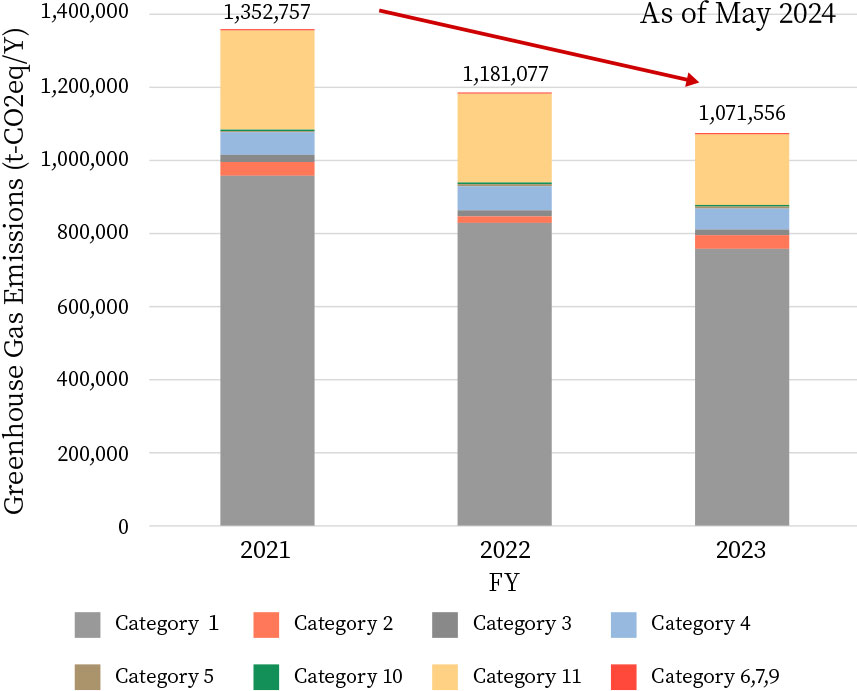

Greenhouse gas emissions (Scope 1 and 2) in FY2024 were reduced by approximately 20% compared to FY2013. (Figure 7)

The reduction was primarily attributable to Tomoku (non-consolidated) switching its Scope 2 electricity consumption to electricity derived from renewable energy sources.

Going forward, we will work to reduce Scope 1 emissions from fossil fuels, while also expanding the use of electricity derived from renewable energy across group companies.

-

Figure 7 Tomoku Group Greenhouse Gas Emissions (Scope 1 and 2)

-

At this stage, the widespread adoption of advanced decarbonization technologies remains limited, making significant reductions challenging in the short term. However, we will continue to promote initiatives that maximize the use of existing resources and technologies, including further efficiency improvements in equipment and operations, fostering a strong awareness of conservation in daily activities, and enhancing regular maintenance of facilities.

We will also continue to gather information on technological advancements and emerging solutions, and respond flexibly in accordance with future developments.* The FY 2023 results are subject to limited assurance by a third party

** As of June 2025

The Tomoku group's greenhouse gas emissions include not only consolidated companies but also non-consolidated entities that meet the GHG Protocol's control approach. Additionally, emission figures for past fiscal years may fluctuate due to business acquisitions and other factors

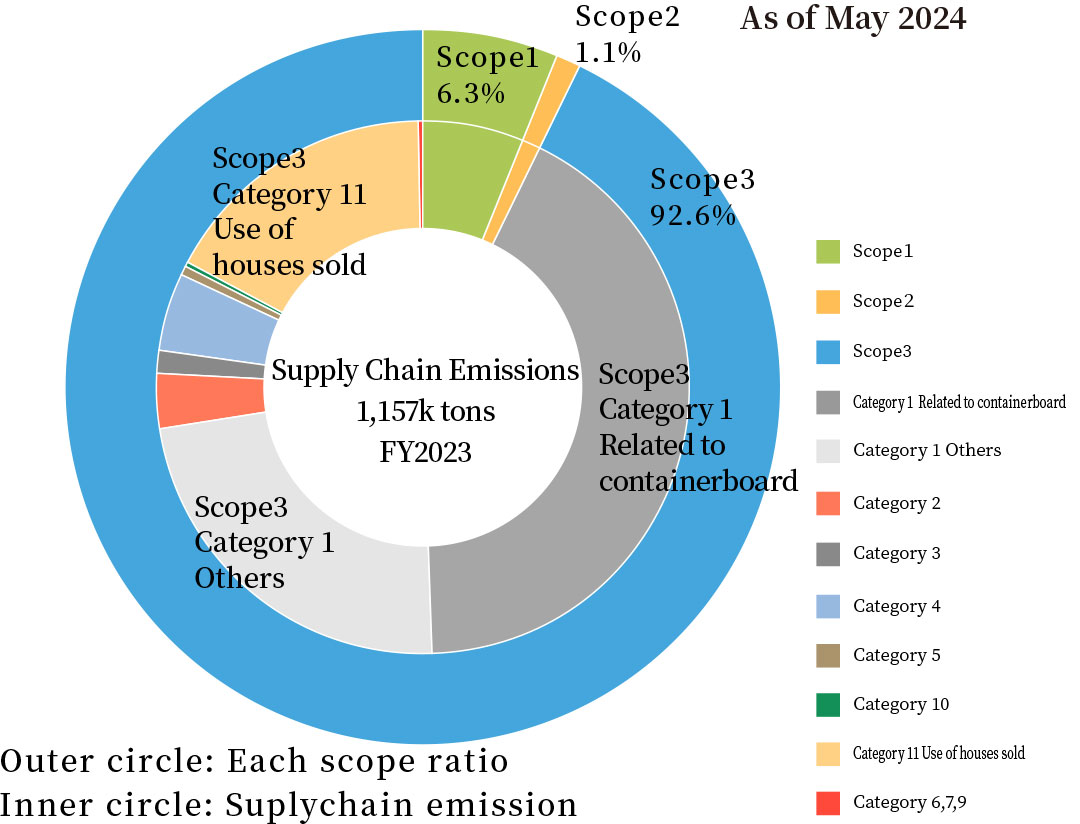

The total supply chain emissions (Scope 1, 2, and 3) for FY 2024 amounted to approximately 1,067 thousand tons. (Figure 8*)

Scope 3 accounts for approximately 92% of total emissions, with Category 1 (Purchased goods and services) making up about 70% and Category 11 (Use of sold products) about 17% within Scope 3.

Category 1 mainly consists of containerboard used as raw materials in the Corrugated Container and Display Carton Business, while Category 11 is largely comprised of emissions from the use of houses sold in the Housing Business.

Scope 3 emissions are on a decreasing trend, mainly due to reductions in Category 1. (Figure 9*)

Regarding the emission factor for containerboard, IDEA Ver.2** was used in FY2021, data published by the Japan Paper Association*** was used in FY2022, and from FY2023 onward, a combination of primary data from containerboard purchased by Tomoku (non-consolidated) and the Japan Paper Association** data has been applied. This approach continues in FY2024.

Going forward, we will strive to secure understanding for expanding the collection of primary data to calculate emissions more accurately.

The reason for the high proportion in Category 11 (Use of houses sold) lies in the features of Sweden House, the flagship of our group’s Housing Business. Although its primary energy consumption is well below energy-saving standards, it offers exceptional durability with a lifespan of 90 years, far exceeding that of ordinary houses.

We will continue to promote the design of houses with low BEI (Building Energy Index) values (0.58 in FY2024), and strive to reduce emissions from residential use.

* The Tomoku group's greenhouse gas emissions include not only consolidated companies but also non-consolidated entities that meet the GHG Protocol's control approach. Additionally, emission figures for past fiscal years may fluctuate due to business acquisitions and other factors

** Sustainable Management Promotion Organization

*** ‘CO2 Emissions in the Life Cycle of Containerboard' by the Japan Paper Association, February 20, 2023

Figure 8* TOMOKU Group Supply Chain Emissions (Scope 1, 2, and 3)

Figure 9* Tomoku Group Greenhouse Gas Emissions (Scope 3)